Her gün binlerce kullanıcının bahsegel giriş giriş yaptığı, yüksek performanslı sunucularıyla kesintisiz erişim sağlar.

Türkiye’de bahis dünyasına adım atmak isteyen bettilt giriş kullanıcılar için platformu güvenilir seçenekleriyle dikkat çekiyor.

Dijital ortamda kazanç sağlamak isteyenler Casinomhub sistemlerini tercih ediyor.

Bahis tutkunlarının tercihi olan bettilt hizmet kalitesiyle öne çıkıyor.

Rulet, blackjack ve slot oyunlarını deneyimlemek için bettilt sayfasına giriş yapılmalı.

Bahis yaparken eğlenmek ve kazanmak isteyen herkes için bahsegel doğru adres.

Adres sorunlarını aşmak için bettilt güncel olarak kontrol ediliyor.

Bahis dünyasında teknolojiyi en iyi kullanan sitelerden biri bahsegel olarak bilinir.

Avrupa’da bahis oynayan kullanıcıların %40’ı ortalama haftada iki kez oyun oynar ve bettilt güncel link bu ritme uygun promosyonlarla hizmet verir.

Türkiye’deki bahis severlerin ilk tercihi bahsegel giriş olmaya devam ediyor.

Türk bahis severler en çok Avrupa futbol liglerine ilgi gösterir, bettilt giriş adresi geniş maç arşiviyle hizmet verir.

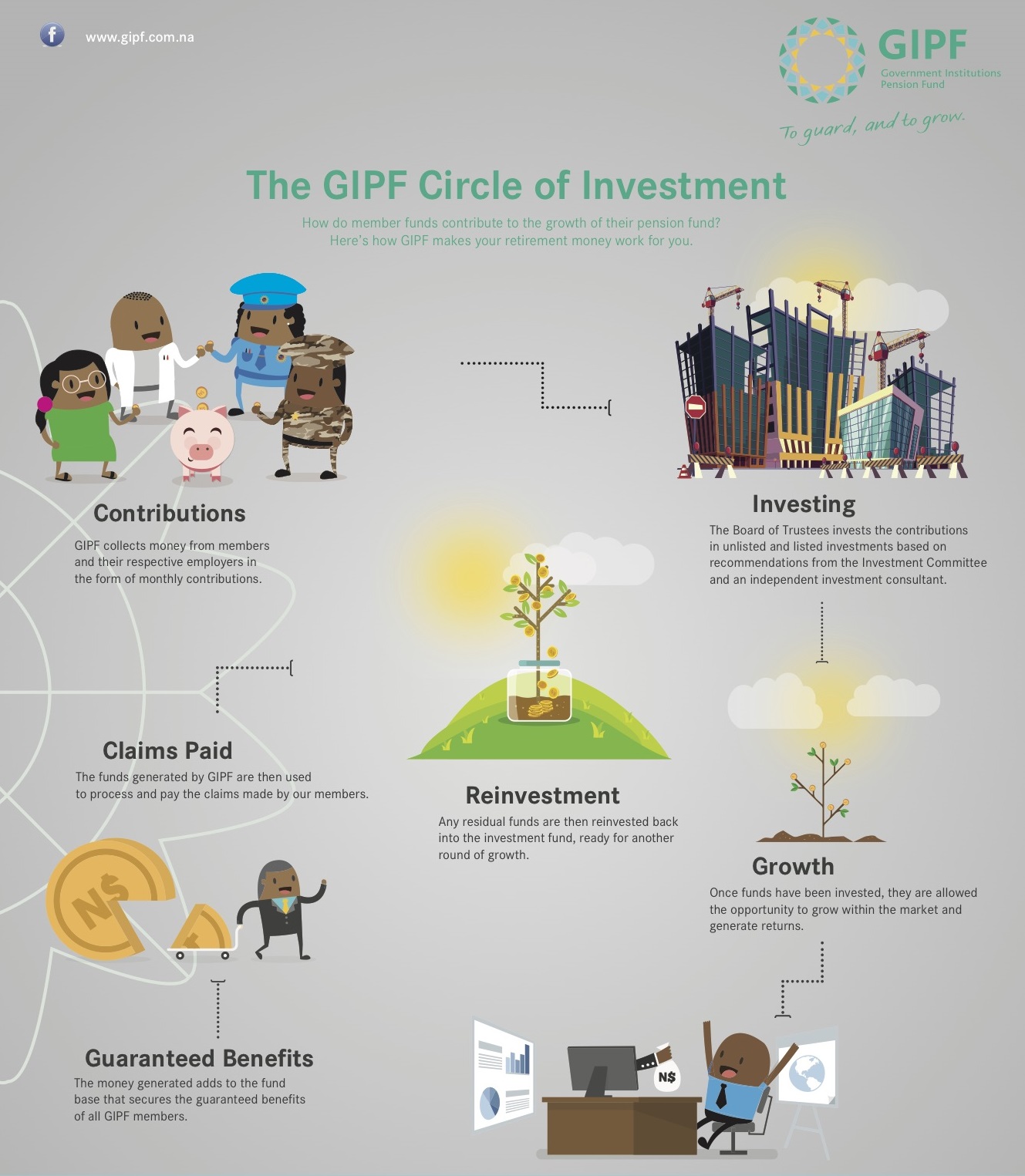

The Board of Trustees recognises that GIPF represents a significant proportion of the savings of the nation and should be invested in a manner that reflects this responsibility. The GIPF Investment Strategy and Policy document provides a framework in which the GIPF’s management, Investment Committee and Board can take investment decisions, and is maintained on a “live” basis, with all changes, such as the split of assets incorporated on an ongoing basis. GIPF’s cash flow is utilised as the need arises to ensure that the regional split remains in line with the Fund’s strategic asset allocation, as amended by the Board from time to time. The Investment Policy and Strategy complies with the provisions of Regulation 13 of the Pension Funds Act, 1956.

The investment strategy and policy in particular, actively supports Government endeavours to stimulate and grow the domestic economy and provides the framework to ensure that the Fund complies with the regulatory requirement of investing 45% of its assets in Namibia. While recognising the challenges of a small and relatively illiquid Namibian stock market, with the GIPF’s investments representing a significant portion of the market, the Fund, as of 31 March 2021, had 46% (2020: 39%) of its assets invested in Namibia.

The GIPF is a major investor in the Namibian economy through its investments in the following categories:

- Listed: instruments listed on a formalised stock exchange

- Unlisted: alternative investments such as private equity and venture capital

- Treasury: fixed investment instruments such as bonds, cash and negotiable certificates of deposit

Proxy Voting Policy

Responsible Investing Policy

GIPF believes that exercising a vote regarding many of the issues raised at shareholder meetings, may well result in improved corporate governance, and social and environmental impact that the company has, all with positive results on the sustainability and performance of the business. It is in this spirit that all votes be exercised by taking into account the GIPF’s Responsible Investment Policy which contains Proxy Voting Guidelines, which sets out the standards of governance that should be observed by investee companies, as well as the rules of engagement between GIPF, as the asset owner, and portfolio companies.

With a vision to be a leading and model pension fund globally, the GIPF continues to benchmark itself against world’s best practices and standards in order to achieve and maintain excellence in all areas of operation. An area which received particular focus during the year was to cement the commitment GIPF made as signatory to the United Nations Principles for Responsible Investing (UN PRI). As a global institutional investor, GIPF acknowledges its fiduciary duty to act in the best long-term interests of its beneficiaries.